According to a new survey, the pandemic has increased mattress shopping, with emphasis on king-size models and sleep accessories

The Covid-19 pandemic has impacted the mattress marketplace in a number of significant ways, a consumer study reveals.

Consumers affected by the pandemic are more likely to look for a new mattress, especially a king-size model; purchase sleep accessories like pillows, sheets, mattress pads and mattress protectors; and cite home improvement projects as a trigger for mattress replacement.

Those are some of the key findings of a major consumer research study conducted by the Better Sleep Council, the consumer education arm of the International Sleep Products Association

Sleep Savvy is taking a deep dive into the survey findings this year in a six-part series, “The Mind of the Mattress Shopper.” It provides an overview of key consumer insights on mattresses and the mattress shopping process.

The insights are important particularly as retailers assess the impacts of the Covid-19 pandemic, which continues to affect consumer behavior this year, although the recent introduction of vaccines has brought hope that the pandemic can be brought under control sometime this year and that consumer behavior could return to a more normal footing.

As a number of analysts have noted, the pandemic has created a renewed focus on the home, a development that, not surprisingly, has had beneficial results for home products like mattresses and sleep accessories, key elements of consumers’ home cocoons.

“It is critical that bedding retailers understand changing consumer perceptions brought about by the Covid-19 pandemic,” said Mary Helen Rogers, vice president of marketing and communications for ISPA. “This BSC study identifies how the pandemic has changed consumer behaviors that benefit the industry.”

“Although the future course of the pandemic cannot be precisely determined at this point, the focus on the home it has generated has the potential to be a long-term driver of bedding business,” she continued. “A good mattress and good sleep accessories to complement it are at the very heart of consumers’ lives, and never more so than when their overall health is a priority.”

The nationally projectible BSC survey of 1,000 consumers, part of a regular schedule of BSC consumer studies over the past 25 years, took on added importance as retailers sought to understand how the pandemic has changed consumer attitudes about a number of key products.

Many of the conditions that consumers experienced during the pandemic in 2020 when the survey was conducted continue to be an issue today. For example, consumers said last year that 90% of the stores in their community required customers to wear masks while in their stores. That figure could be even higher today, according to bedding observers.

The survey found that one-quarter of consumers have experienced changes in their living conditions since the pandemic hit, and a similar number have seen decreases in their household income.

But four in 10 consumers said they would consider or be comfortable making larger household purchases.

It also found that consumers who purchased within the past six months of the study, a time in which the pandemic was sweeping the country, were more likely than others to say the mattress they replaced was in very bad or bad condition, an indication their increased time at home caused them to take a closer look at their bedding, the BSC said.

The survey found that consumers under stay-at-home orders were more likely than others to be looking for a mattress. And consumers under stay-at-home orders say they are much more likely than others to plan to buy a king-size mattress.

In addition, consumers currently under stay-at-home orders are more likely than others to say that home improvement/lifestyle issues are a trigger for mattress replacement, with 40% expressing that view.

Examining information sources that consumers use to research mattresses, the survey found that since 2016, the percentage of consumers saying they are going to stores to look around has decreased from 57% to 36%, a finding that is attributable, at least in part, to the coronavirus pandemic, the BSC said.

The consumers also said that during stay-at-home orders, boxed beds, appointment-only shopping, attractive websites and online chats have all assumed added importance to them.

Survey respondents also expressed a heightened interest in a wide range of sleep accessories. For example, consumers under stay-at-home orders said they were more likely to purchase pillows, sheets, mattress pads, mattress protectors, comforters, mattress toppers, bed covers and decorative pillows.

“These survey findings underscore the growing importance of sleep accessories,” Rogers said. “Consumers increasingly recognize that sleep accessories add comfort to their bedrooms at a challenging time in our nation’s history when comfort is more important than ever.”

The Role of Better Sleep

Consumers under stay-at-home orders put more emphasis on their sleep, research reveals

Consumers responding in 2020 to a survey by the Better Sleep Council, the consumer education arm of the International Sleep Products Association, were twice as likely as those who responded to a similar survey in 2016 to say they are getting more than enough sleep.

And that change may be due, at least in part, to the impact of the coronavirus pandemic, the BSC said. It noted that consumers under stay-at-home orders are nearly four times more likely than others to say they were getting more than enough sleep.

In 2016, just 6% of consumers reported getting more than enough sleep. Last year the figure jumped to 13%, the survey found.

“It is encouraging to see that more consumers are reporting that they are getting more than enough sleep,” said Mary Helen Rogers, vice president of marketing and communications for the ISPA. “Still, a significant number of Americans say they are not getting enough sleep, an issue that the BSC continues to address with a variety of strategies.”

In 2016, 41% of consumers said they were not getting enough sleep. While that figure dropped five percentage points to 36% last year, that still means that more than one in three Americans does not get enough sleep.

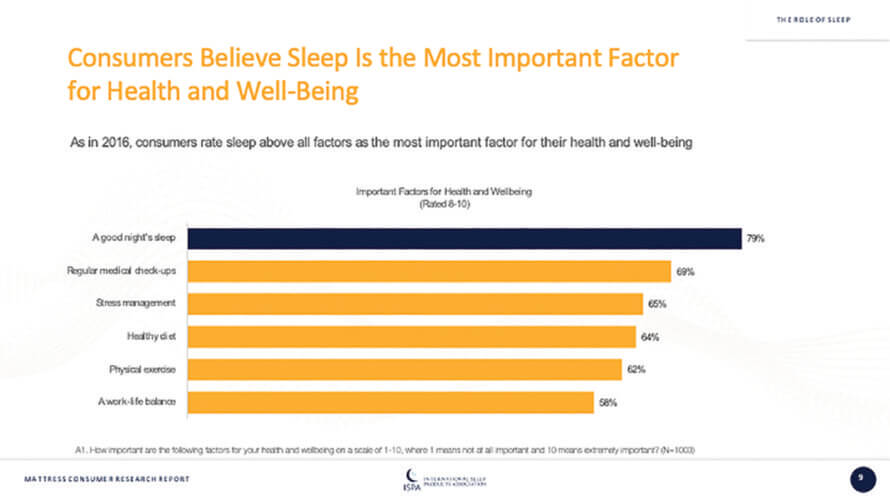

The latest BSC survey found that consumers believe sleep is the most important factor for health and well-being, with 79% of consumers expressing that view. That is even higher than the percentage of consumers saying that regular medical checkups are important (69%), that stress management is important (65%), that a healthy diet is important (64%), and that physical exercise is important (62%).

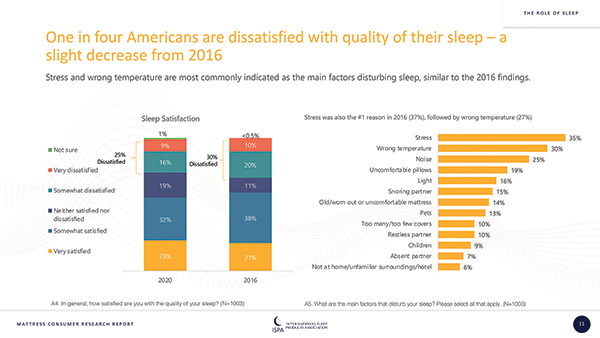

The research also found that one in four Americans are dissatisfied with the quality of their sleep — a slight decrease from the 2016 findings.

And, as in 2016, the consumers cited stress and the wrong temperature as the top factors that disturb their sleep. While 35% of consumers said in 2020 that stress was the main factor that disturbed their sleep, that was two percentage points lower than in 2016.

Wrong temperature (30%), noise (25%), uncomfortable pillows (19%), light (16%), a snoring partner (15%), an old, worn-out or uncomfortable mattress (14%), pets (13%), and too many or too few covers (10%) were cited as other factors that disturb sleep in the 2020 survey.

The BSC survey also documented consumers’ use of sleep-tracking devices and apps. It found that 25% of consumers say they use wearable tracking devices like Apple watches and Fitbits, with 15% saying they use a sleep-tracking app, and 13% saying they use a sleep tracker that is part of or connected to their mattress or bedding.

The use of sleep trackers that are part of the mattress is more common among adults ages 18 to 35. Twenty-nine percent of people in the age group reported using those trackers, a higher percentage than any other age group, the BSC study found.

Retail Playbook: Selling Better Sleep in a Covid-19 World

In a recent survey, Better Sleep Council research affirms the importance of sleep to health, a vital finding as consumers battle the Covid-19 pandemic. (The BSC is the consumer education arm of the International Sleep Products Association.) Here are five ways the research can help retailers:

1. Emphasize the sleep-health connection

O Insight: Consumers believe sleep is the most important factor for health and well-being. A good night’s sleep was cited by 79% of survey respondents as being important for their health and well-being.

O Application: Want to connect with today’s increasingly health-conscious consumers? Talk about the benefits of a good night of sleep. As the BSC survey finding demonstrates, consumers clearly believe in the primacy of sleep to their health. Retailers need to tout better sleep messages in their advertising.

2. Seize the opportunity with sleep-deprived consumers

O Insight: More than one in three Americans (36%) does not get enough sleep.

O Application: “Not getting enough sleep?” That’s a great message for retail ads, one that will resonate with many consumers. While there are numerous ways consumers can seek better sleep — sleeping pills, noise machines, warm baths, relaxation rituals at bedtime, etc. — a good night’s sleep starts with a good mattress. That’s a message that mattress retailers must never forget.

3. Talk better sleep during stay-at-home requirements

O Insight: Consumers under Covid-19 stay-at-home orders are nearly four times more likely than others to say they are getting more than enough sleep.

O Application: A good night’s sleep is an important way for consumers to protect their health during the Covid pandemic. This BSC survey finding shows consumers realize that good sleep is especially important these days and are working to make sure they get it.

4. Reach out to consumers dissatisfied with their sleep

O Insight: One in four consumers (25%) is dissatisfied with the quality of his or her sleep.

O Application: While there is more focus than ever on the importance of a good night’s sleep, too many consumers still are not happy with their sleep. Retailers can win by appealing to these consumers.

5. Tout the comfort of sleep accessories

O Insight: BSC research reports that 28% of consumers under stay-at-home orders purchased pillows with their last mattress purchase. That’s a much higher percentage than when earlier Covid restrictions were lifted.

O Application: Savvy retailers have long appreciated the role that sleep accessories play in adding comfort and building sales tickets. That role has taken on added importance during the pandemic, when consumers say they are more likely to purchase a range of sleep accessories. Retailers should include sleep accessories in their mattress ads — and even give them star billing in their own ads.