Consumer preference for online mattress buying continues to rise, but brick-and-mortar stores remain important, a Better Sleep Council survey shows

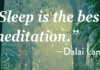

Consumer preference for purchasing mattresses online has risen sharply in recent years, with almost half of consumers now saying they would purchase online.

And an overwhelming majority of respondents ages 18 to 35 now say they would purchase a mattress online, although an even higher percentage of those younger consumers say they would be willing to purchase a mattress from a brick-and-mortar store.

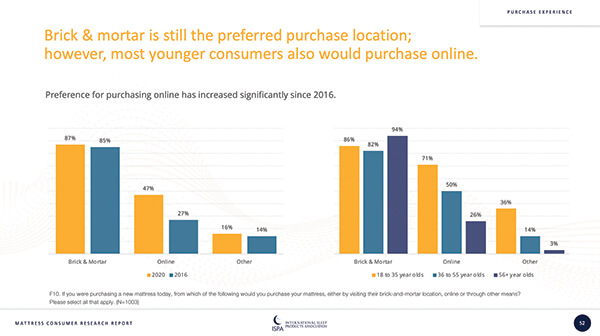

The survey also found that about eight in 10 consumers (78%) were satisfied with their most recent shopping experience, a slight decrease from 2016, when shopping satisfaction stood at 83%. Nearly one-third of the consumers responding to the latest survey said they were “very satisfied” with their most recent mattress shopping experience.

These are some of the key findings from a broad round of consumer research conducted for the Better Sleep Council, the consumer education arm of the International Sleep Products Association.

That nationally projectible study of more than 1,000 consumers was conducted last year as part of the BSC’s regular tracking of consumer sentiments on a variety of key bedding issues.

The latest round of research found that while 87% of consumers say they would purchase a mattress from a brick-and-mortar store — up two percentage points from similar research conducted in 2016 — interest in online mattress purchasing has risen sharply — up 20 percentage points in 2020 to 47%, versus just 27% in 2016.

While a majority of consumers in the 18-to-35, 36-to-55 and 56-plus age groups say they would buy from a brick-and-mortar location — with 86%, 82% and 94%, respectively, offering those views — preference for online purchases also is high. In the 18-to-35 age group, 71% of consumers said they would buy online, while 50% of consumers in the 36-to-55 age group said they would buy online. But just one in four consumers — 26% — in the 56-plus age category said they would buy online, the research found.

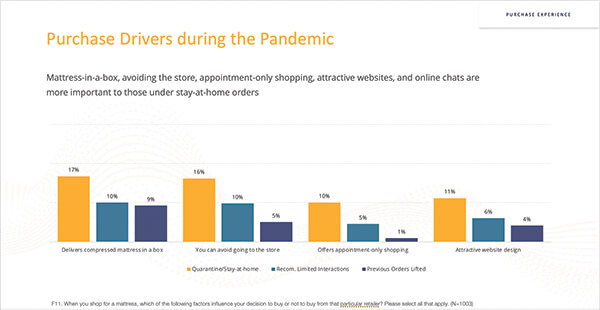

“While these results are not surprising, they are significant,” notes Mary Helen Rogers, vice president of communications and marketing for ISPA. “Brick-and-mortar retailing retains its preeminent position in mattress buyers’ minds, but many consumers are more open nowadays to online shopping. And the Covid-19 pandemic has only accelerated the trend toward online mattress shopping and buying.”

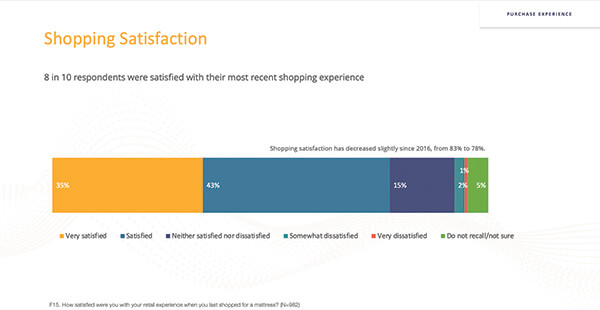

The BSC research also found that mattress specialty chains like Mattress Firm have an edge in the market over other types of retailers, with 45% of the consumers saying they would purchase from a mattress specialty chain. Furniture stores were next, cited by 42% of respondents, while department stores were third, cited by 40% of respondents. Local independent mattress specialty stores were next (35%), followed by single-brand retailers, such as Sleep Number or Tempur-Pedic (33%), and mattress retailers like Casper that sell mostly online (31%).

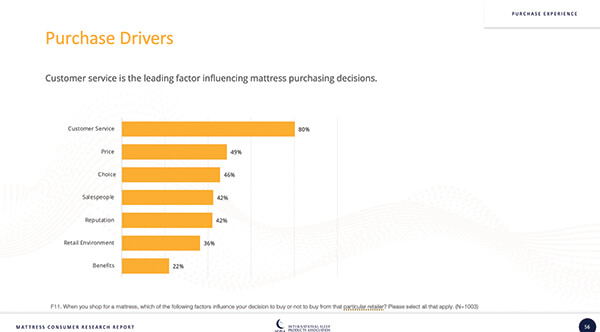

What drives a purchase?

The BSC research also looked at purchase drivers, finding that customer service is the leading factor influencing mattress purchasing decisions, cited by 80% of respondents. The most important customer service issues are

free delivery, free pickup of discarded/old mattresses, a long-term warranty, easy returns and the fact that a retailer sends discarded mattresses to a recycler.

The second most important factor influencing mattress purchasing decisions, cited by 49% of respondents, is price, with low prices or discounts and financing being the most important factors.

Third on the list is choice, cited by 46% of respondents, with a wide selection of mattress options and the ability to do comparison shopping being the two top factors.

The fourth purchase driver is salespeople, cited by 42% of respondents. Consumers said they want nonpushy and knowledgeable salespeople in the store.

Tied for No. 4 with salespeople is reputation. Consumers said they want a well-known mattress brand, are interested in the retailer’s reputation and want to support local businesses.

Next on the list of factors influencing mattress purchasing decisions is the retail environment, cited by 36% of respondents. Consumers said they are looking at cleanliness and the appearance of the store, favor retailers who display mattresses the way they would look in the bedroom, and are seeking attractive website designs.

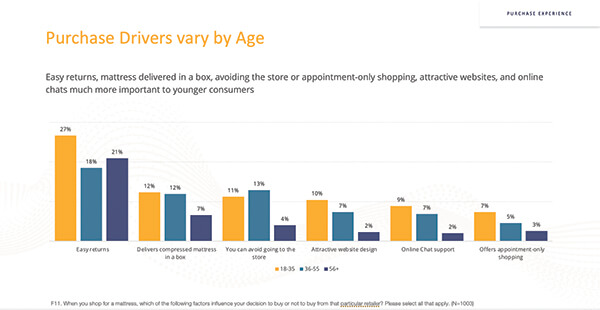

Purchase drivers vary by age. Easy returns, mattresses delivered in a box, the ability to avoid the store, appointment-only shopping, attractive websites and online chats are much more important to younger consumers than older consumers, the research found.

Easy returns are most important to consumers ages 18 to 35, cited by 27% of consumers; those 36 to 55, cited by 18% of respondents; and those 56-plus, cited by 21% of respondents.

The research also found that 63% of consumers said they spoke to a salesperson or a customer service representative. Older consumers, those 56 and older, were the most likely to have done so.

Of those consumers who spoke to a salesperson, 45% said the salesperson talked a lot about comfort and support, while 35% talked a lot about the construction features, 32% talked a lot about a price savings, and 29% talked a lot about sleep/health benefits.

The survey also found that 43% of those who talked to a salesperson said that person did not talk at all about a free trial period at home, while 36% did not talk at all about bedding accessories, and 30% did not talk at all about easy returns.

All About Accessories

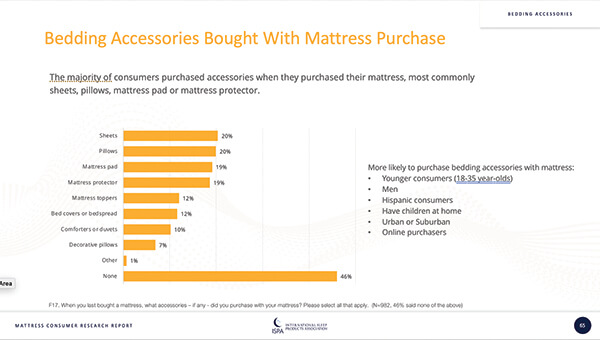

Sheets and pillows are the most commonly purchased accessories when consumers buy a mattress

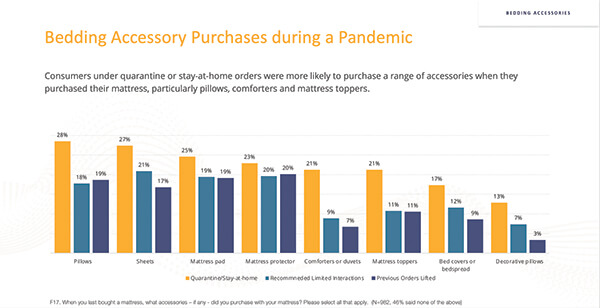

Sheets and pillows are the two bedding accessories consumers purchase most frequently when they buy a mattress. Mattress pads and mattress protectors also are high on the list of accessories that those consumers purchase.

A broad consumer study conducted in 2020 for the Better Sleep Council, the consumer education arm of the International Sleep Products Association, reveals new insights into the role that bedding accessories play in the mattress purchase and details the types of retailers from which consumers typically buy accessories.

The survey found that the majority of consumers purchased accessories when they last purchased a mattress, with 20% saying they bought sheets, another 20% saying they bought pillows, 19% saying they bought a mattress pad and 19% saying they bought a mattress protector.

In addition, 12% of consumers said they bought a mattress topper when they last bought a mattress, 12% said they bought bed covers or a bedspread, 10% said they bought comforters or duvets and 7% said they bought decorative pillows.

“These findings should be particularly helpful to mattress retailers, as they clearly illustrate the add-on sale opportunities provided by bedding accessories,” says Mary Helen Rogers, ISPA’s vice president of communications and marketing. “Bedding accessories add comfort and they also help retailers build their tickets, a particularly important factor at a time when retail traffic levels remain challenged.”

The research found that consumers ages 18 to 35 are more likely to purchase bedding accessories with a mattress than other consumers. Male consumers are more likely to buy bedding accessories with a mattress, as are Hispanic consumers, consumers with children at home, urban and suburban consumers, and online purchasers.

The survey found that more consumers use mattress pads (46%) than mattress protectors (33%) and mattress toppers (21%). The use of mattress protectors and mattress toppers was higher in 2020 than it was in 2016, when a similar study was conducted.

The BSC regularly samples consumer opinions to monitor changes in the mattress marketplace.

The latest survey found that older consumers are more likely than younger consumers to use mattress pads, while younger consumers are more likely than their older counterparts to use mattress toppers.

The study found that 34% of consumers said they typically buy bedding accessories at discount stores like Walmart, while 26% said they typically buy those accessories at a department store. Another 26% said they typically buy them at specialty bedding stores and another 26% said they typically buy them at online retailers like Amazon or Overstock.

The survey also found that more than half of the consumers said they were very interested (24%) or somewhat interested (28%) in buying accessories at a mattress store.

“Consumers are clearly interested in purchasing bedding accessories at mattress stores,” Rogers says. “Armed with that knowledge, mattress stores might consider boosting their sleep accessory offerings.”